The Single Strategy To Use For Accountants

Wiki Article

The Best Strategy To Use For Accountants And Auditors

Table of ContentsUnknown Facts About Accountants ServicesAccountants And Auditors Things To Know Before You BuySome Known Questions About Accountants Responsibilities.How Accountants Qualifications can Save You Time, Stress, and Money.How Accountants And Auditors can Save You Time, Stress, and Money.A Biased View of Accountants Responsibilities

Whether you benefit a business or run your own accounting firm, your companies or customers need to be able to trust you with their monetary details. If other individuals in your life know that you're honest which they can trust you with delicate info, you may think about becoming an accounting professional.Being an accounting professional suggests having to explain financial resources as well as monetary info to customers or co-workers who aren't familiar with accountancy terms. accountants services. If you're efficient discussing challenging or challenging concepts in basic, easy-to-understand terms, this is an excellent high quality to have as an accountant. Being able to function well with others can aid you grow in accountancy.

Getting The Accountants To Work

Accounting professionals need to have a sense of responsibility when these sort of concerns come up, such as during an audit. Being an accountant involves making judgment calls once in a while. If you want to approve duty when points fail and take steps to remedy your blunders, you have yet another quality that makes an excellent accounting professional.Being in accounting methods dealing with problems and difficulties every so often. You'll need to be going to see these difficulties with in order to succeed in this field. Being efficient as an accountant involves locating ways to remain efficient or improve performance, as required. When you're efficient, you may additionally have the ability to help your company enhance its effectiveness overall.

If you can do basic mathematics troubles, including adding and also subtracting, you'll have a very easy time doing these computations as an accountant. Maintain in mind that you'll have technology tools to assist you handle much more complex math estimations, and you won't need to have a thorough understanding of trigonometry, algebra, or other sophisticated mathematical concepts to master bookkeeping.

Accountants Firms for Dummies

You'll require time management abilities to make certain you're able to finish your service time without really feeling bewildered. If you have an interest in finding out more concerning the accounting degree used at Wilmington University Cincinnati, demand information today! (accountants responsibilities).Team accountants work in a firm's division. They commonly report to a Senior Accountant, weblink Accountancy Supervisor, Controller, or Principal Financial Police Officer. Team accountants are necessary. A staff accountant setting is normally taken into consideration a slightly above employee. While an accountant setting is frequently extra skilled than your regular team accountants.

And if the accountant is really modest as well as likes modesty versus being braggadocious, an accountant can be someone in monitoring. This sort of expert sort to be referred to as what they are at their core. Accounting professionals often are appointed tasks on preserving tracking expenditures as well as budget plans. Whereas staff accounting professionals have normally fewer qualifications and are offered less obligations.

8 Simple Techniques For Accountants And Auditors

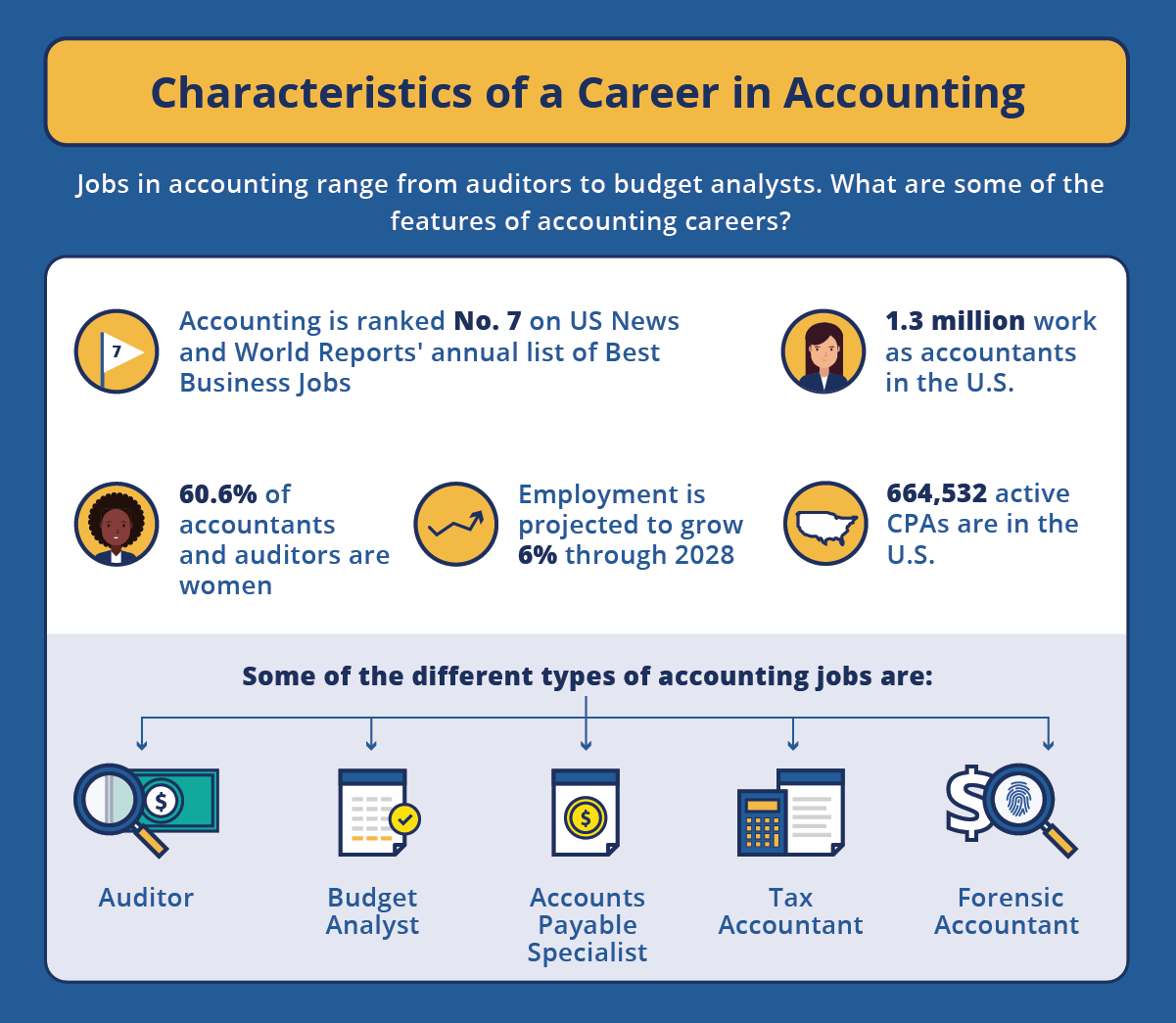

The classification of "" means Certified Public Accountant. Although a position for a personnel accounting professional does not normally require a CPA credential (these settings truly never ever do), it will be the hope useful content frequently that a personnel accountant intends to research and take the. Becoming a CPA prospect will certainly be wonderful information to most employers.

The smart Trick of Accountants Qualifications That Nobody is Talking About

They should be able to be positive in their ability to utilize computer systems abilities to learn and also make use of fundamental accountancy software application such as or. The general kinds of bookkeeping are,,, as well as.

In huge openly traded companies, the (CFO), look at more info is the accounting and also finance leading canine. In various other firms, the title of indicates the highest-ranked accounting professional on staff.

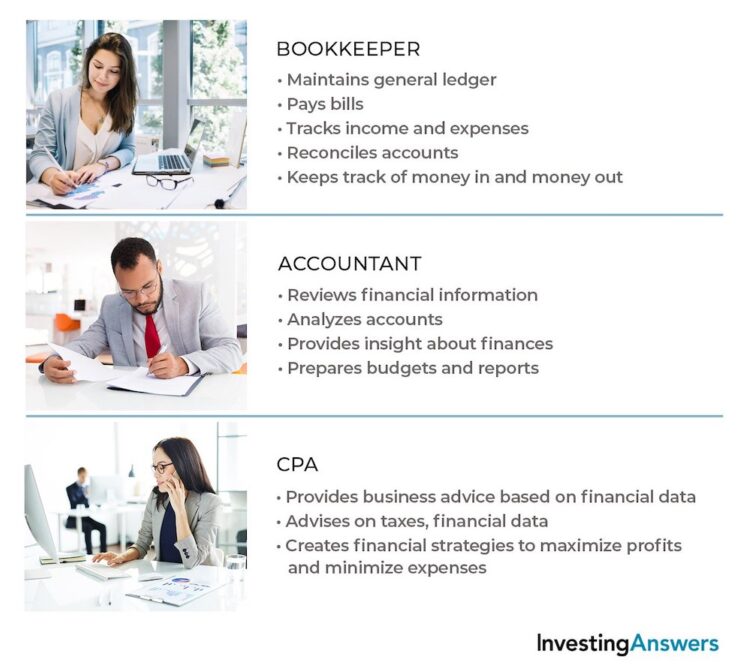

The sorts of accountants (depending on that you ask) in some circles are referred to as Cost Accountants, Managerial Accountants, as well as Financial Accountants. A CPA as well as an accountant are not mutually unique. They are terms that can be synonymous with each various other. An accounting professional who has passed the requirement to attain the standing of certified public accountant or Cpa is taken into consideration even more competent and well-informed as well as can command a greater wage.

Our Accountants And Auditors Statements

These settings and also the hiring managers entailed may prefer candidates/employees that have their. That's if they had their druthers. If you desire a higher-paying setting with even more duty, a CPA credential deserves going after. Yes absolutely, but you will certainly probably make a higher salary as a CERTIFIED PUBLIC ACCOUNTANT.All that said, there's a substantial number of accountants that do not have a CERTIFIED PUBLIC ACCOUNTANT. For many, going after a Certified public accountant license is not worth the necessary time financial investment to accomplish licensure.

Report this wiki page